net investment income tax 2021 form

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. This change comes after President Biden signed the American Rescue Plan Act of 2021 ARPA into law on March 11th 2021.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Your net investment income is less than your MAGI overage.

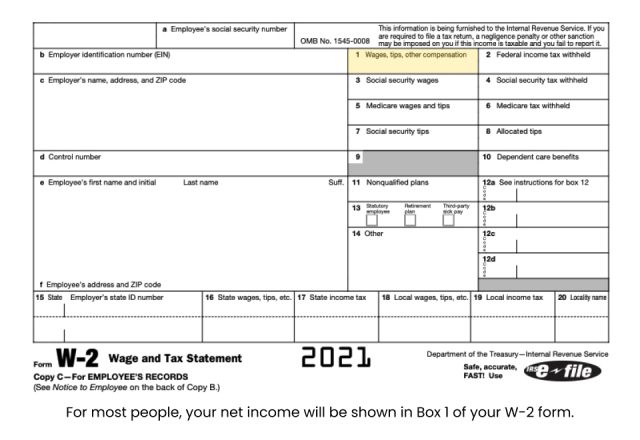

. From within your TaxAct return Online or Desktop click on the Federal tab. Since 2013 certain higher-income individuals have been. Taxpayers use this form to figure the amount of their net investment income tax NIIT.

But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. Use Get Form or simply click on the template preview to open it in the editor. Online Federal Tax Forms.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US. The NIIT is contained in Section 1411 of the Internal Revenue Code and applies a tax rate of 38 percent to the net investment income of individuals estates and trusts that have income above specific thresholds.

I would think it is the Federal Refund I received the 2020 federal refund in. The IRS has recently introduced a couple of changes to the 2022 1099-K reporting. According to Forbes the bill specifies the minimum threshold has been lowered for Form 1099-K a form filed by the Payment Settlement Entities1099-NEC Form.

April 8 2021 756 AM. All About the Net Investment Income Tax. The statutory authority for the tax is.

The 38 Net Investment Income Tax. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers income for regular income tax to 490000. To make entries for Form 8960 Net Investment Income Tax.

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Free Online Classes Open an Account Today. Use the Cross or Check marks in the top toolbar to select your answers in.

Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion of your state local and foreign income taxes allocable to net investment income using any reasonable method. Click Taxes in the middle of the screen to expand that category then click Net investment income tax Form 8960. Complete Edit or Print Tax Forms Instantly.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Access IRS Tax Forms. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS.

You wont know for sure until you fill out Form 8960 to calculate your total net investment income. From Simple to Advanced Income Taxes. Updated for Tax Year 2021 August 17 2022 0517 PM.

Youll owe the 38 tax. In general net investment income for purpose of this tax includes but isnt limited to. This tax must be reported on Form 990-PF Return of.

1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect. Start completing the fillable fields and carefully type in required information. It states on page 11.

The individual is entitled to reduce his net investment income by 55000 entered as a negative amount on Form 8960 line 7. A recovery or refund of a previously deducted item increases net investment income in the year of the recovery It does not state whether it is the recovery of the state income tax refund or the federal income tax refund. It applies to income from these sources.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. Short or long term capital gains. Ad IRS-Approved E-File Provider.

Future Developments For the latest information about developments related to Form 8960 and its instructions such as legislation. Over 50 Milllion Tax Returns Filed. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

Quickly Prepare and File Your 2021 Tax Return. Ad Go From Rookie to Guru. According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax.

Income Tax Return for Estates and Trusts Schedule G Line 4. If you earn income from any of your investments this year you may have to pay the net investment income tax in addition to the regular income taxes you owe. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. For tax years beginning after Dec. 20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate.

Subject to a 38 unearned income Medicare contribution. Access IRS Tax Forms. Generally net investment income includes gross income from interest dividends annuities and royalties.

You are charged 38 of the lesser of net investment income or the amount by. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Rental or royalty income.

On smaller devices click the menu icon in the upper left-hand corner then select Federal. The IRS gives you a pass. For tax years beginning on or before Dec.

Quick steps to complete and e-sign Form 8960 for 2021 online. Your additional tax would be 1140 038 x 30000. Complete Edit or Print Tax Forms Instantly.

Net investment income can be capital gains interest or dividends. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. Tax more commonly referred to as the net investment.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Fillable Form 1040 Individual Income Tax Return 2022 Printable Blank Pdfliner

Complying With New Schedules K 2 And K 3

What Is The The Net Investment Income Tax Niit Forbes Advisor

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Net Income What Is It How Is It Measured

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Instructions For Form 8995 2021 Internal Revenue Service

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Instructions For Form 1040 Nr 2021 Internal Revenue Service

How To Read Your Brokerage 1099 Tax Form Youtube

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

How To Read Your 1099 Robinhood

State Income Tax Rates Highest Lowest 2021 Changes

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)