how to pay indiana state taxes quarterly

Form WH-1 Withholding Tax Voucher for EFT Early Filer. These regular tax payments are meant to cover Medicare Social Security and your income tax.

E File And E Pay State Forms And Taxes In Quickbooks Desktop Payroll Enhanced

Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you.

. If you dont have a bill or dont know the amount due you can get assistance by. This means you may. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Be sure to denote that you are making an individual income. The penalties are calculated using a complex formula that encompasses factors relating to. When you filed your state return TT would have told you the various options as follows.

We last updated the Estimated. Lines J K and L If you are paying only the. Follow the instructions to make a payment.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Find Indiana tax forms. Find Indiana tax forms.

Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Under non-bill payments click your payment method of choice. Indiana Small Business Development Center.

SBAgovs Business Licenses and Permits Search Tool. Line I This is your estimated tax installment payment. The purchaser will pay the use tax owed on his or her annual Indiana income tax return due April 15.

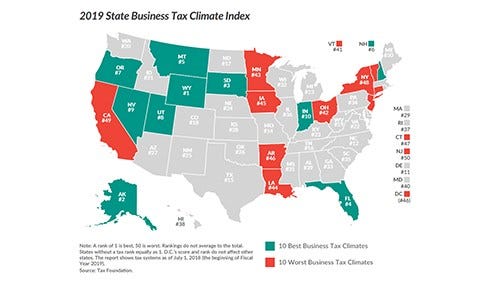

The states SUTA wage base is 7000 per. Know when I will receive my tax refund. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income.

Completing Form ES-40 and. Department of Administration - Procurement Division. Penalties will accrue for any business that fails to pay taxes or for a business that commits fraud.

Bank or credit card. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax. There are several ways you can pay your Indiana state taxes.

What are the payroll tax filing requirements. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. So you should familiarize yourself with how those taxes break down.

How To Pay Indiana State Taxes. Contact DOR at 317-232-0129 to receive an IT-6WTH coupon if you make monthly or. Know when I will receive my tax refund.

Estimated payments may also be made online through Indianas INTIME website. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. The tax bill is a penalty for not making proper estimated tax payments.

Some states also require estimated quarterly taxes. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Forms required to be filed for Indiana payroll are.

For employers who pay employees in Indiana use this guide to learn whats required to start running payroll while keeping compliant with state payroll tax regulations. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Indiana Income Taxes.

Indiana Tax Climate Tops Midwest Inside Indiana Business

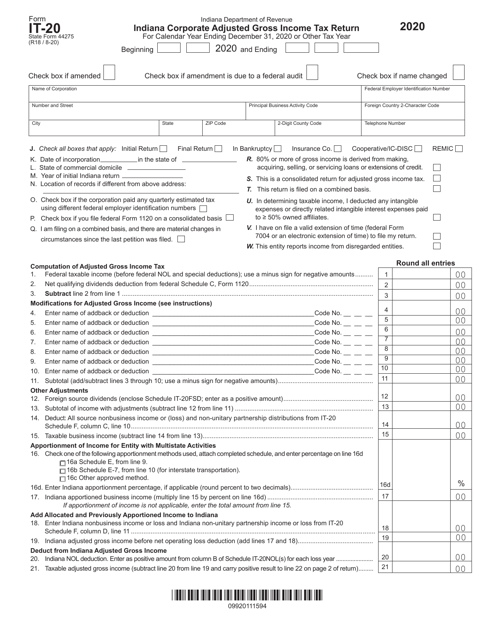

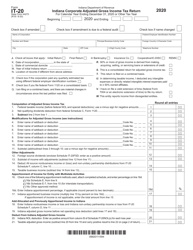

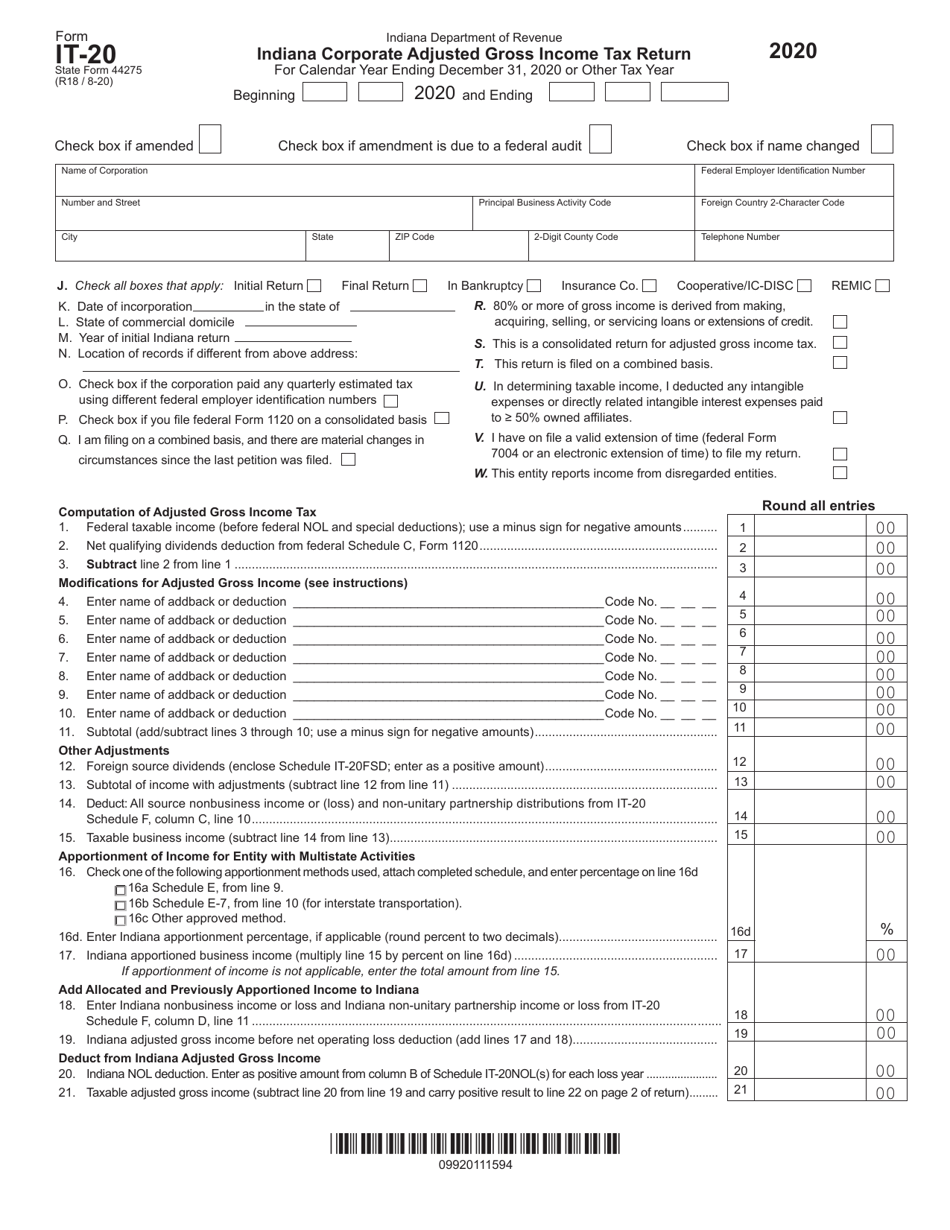

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

E File And E Pay State Forms And Taxes In Quickbooks Desktop Payroll Enhanced

Dor Keep An Eye Out For Estimated Tax Payments

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

Arizona Sales Tax Small Business Guide Truic

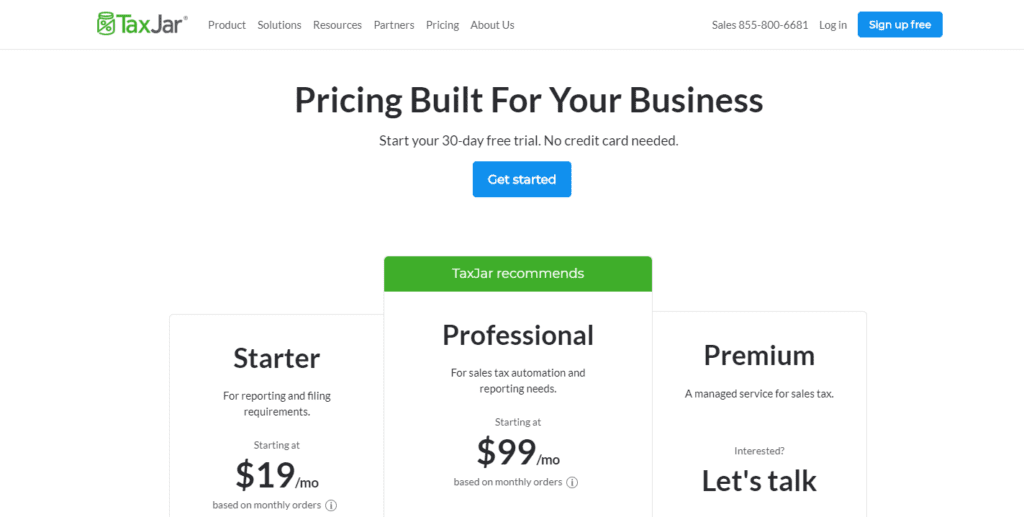

Online Sales Tax Guide By State For Ecommerce Sellers

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

Arizona Sales Tax Small Business Guide Truic

Dor Keep An Eye Out For Estimated Tax Payments

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

.png)